The U.S. economy finished it’s longest economic expansion in history (128 months) arising out of the great financial crisis of 2007-2008. The run from June 2009 through February 2020 was an impressive feat ignited by accommodative monetary policies of central banks around the world. The world learned a great deal from the last global financial crisis and from the economic policies that were enacted to stem an enduring recession. History has, for the most part, looked favorably upon this time and these interventions.

When the pandemic shook the world in early 2020, it put an end to the record expansion. In similar fashion, we saw a swift intervention yet again of the world’s central banks and we saw a recession turnaround quickly due to the accommodative monetary policies around the world. Today the U.S. remains flooded with cash from federal policy intervention while sitting at an unemployment rate of just below 6 percent. Vaccinated populations are rising globally and we’re seeing economies open up at modified rates. With all of this we are seeing a return in consumer demand; supply shortages in things like appliances, lumber, semiconductors, and other industry materials; and soaring housing prices due in-part to a severe supply shortage.

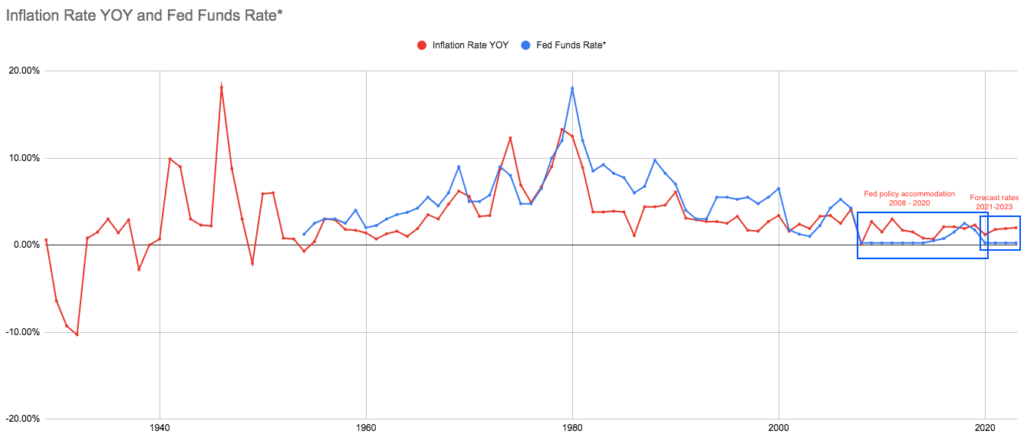

These current events have me looking back at the history of U.S. inflation periods from 1929 to today. I’m left wondering what lessons we are taking from rapid rises in inflation as a result of our economic policy? This is not an attempt to make a political argument for or against either party because, frankly, I’m concerned with both of them. This is an attempt to observe what lessons in U.S. economic policy have we learned from flooding our economies with unprecedented amounts of cash in consecutive years? After a 2020 recovery spend of at least $6 trillion, followed up by another 2021 recovery spend of $1.9 trillion, the current administration and the folks on capitol hill continue discussing an infrastructure plan of $2 trillion. To be clear, I am generally in favor of some federal infrastructure spending with limits, but I strongly believe that now is not the time for it. The federal balance sheet has done its part to support U.S. consumers and businesses during the pandemic shock and it will need some time to heal with our global economy.

I hope that some sobriety on this infrastructure spending topic has taken hold in Washington, but it will resurface soon and when it does I hope our leaders are sober enough to recognize that timing matters.

Source: The Balance